income tax plus self employment tax

Your net earnings from self-employment were 400 or more. Well here it is.

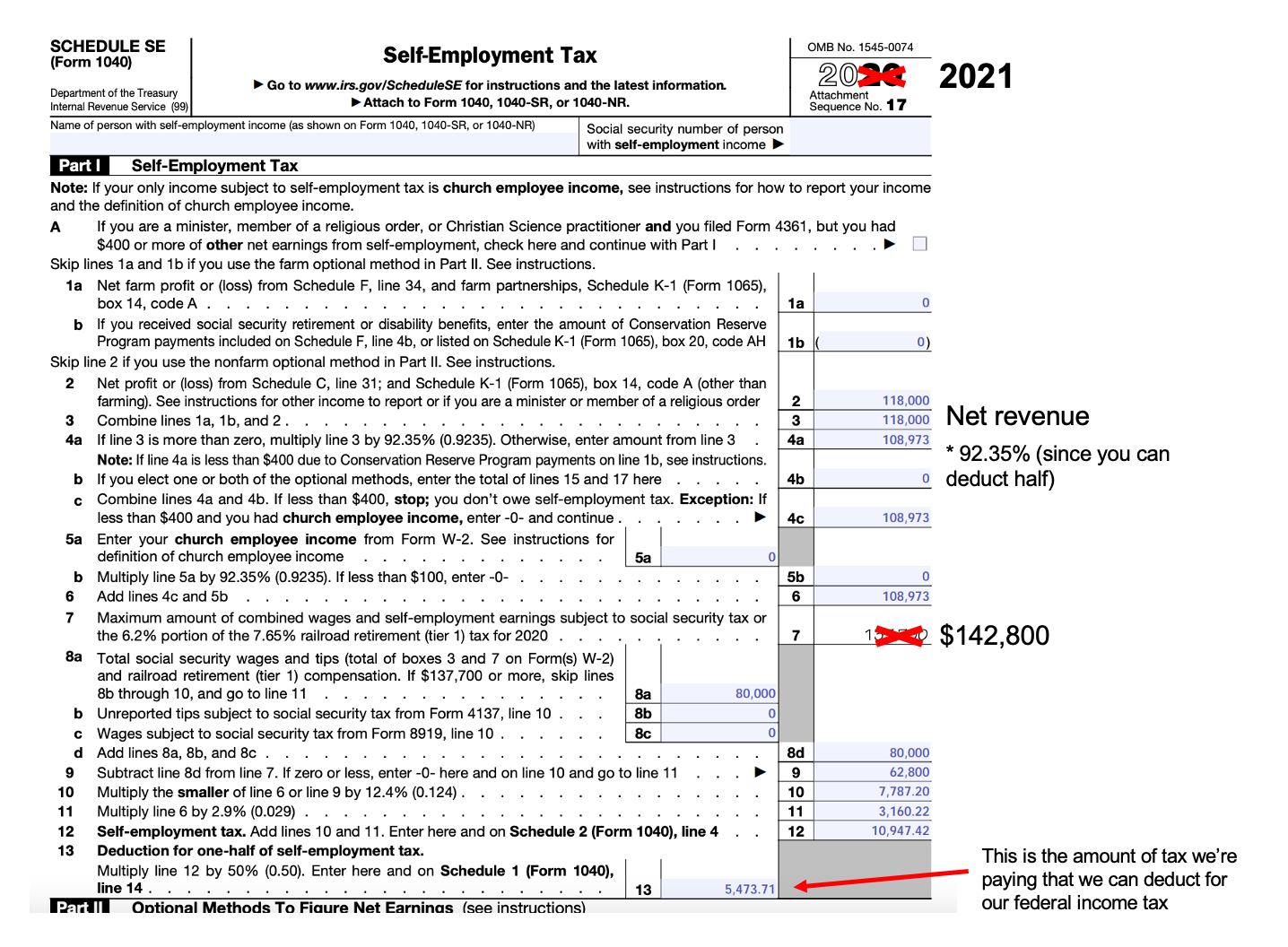

1099 Self Employment Is Now A Better Tax Choice Than A W 2 Salary

The self-employment tax rate is currently 153 of your income.

. The rate is made up of 29 for Medicare or hospital insurance and 124 for social security or survivors old-age and disability. If youre used to the normal W2 structure switching to self-employment taxes comes with a large learning curve. Self-employment tax consists of 124 going to Social Security and 29 going to Medicare.

Self-employment tax is levied on self-employment income and covers Social Security and Medicare taxes. How the IRS Defines Self-Employment Income. A self-employed person pays a 153 tax on their reported earnings.

This rate is composed primarily of the 124 Social Security tax plus the 29 Medicare tax. Self-employed workers are taxed at. You must pay SE tax and file IRS Form 1040 Schedule SE Self-Employment Tax if either of the following applies.

Calculate your self-employment taxes. This number comes from two parts124 for Social Security and 29 for Medicare. Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self-employment tax.

The self-employment tax rate is 153. Medicare can actually be thought of as 2 separate taxes. The tax rate for self-employment taxes is 153.

Self-employed individuals are entitled to a deduction of 50 of their self-employment tax on their individual income tax return. For SE self employment tax - if you have a net profit after expenses of 400 or more you will pay 153 for 2013 SE Tax on 9235 of your net profit in addition to your regular. Self-employed individuals may also be.

Other situations may require you to pay self. The 29 tax we already discussed and an extra 09 tax on all income above a threshold. You do not need to pay self-employment tax on income that you earn from an employer if the employer withheld payroll taxes.

Discover How To Manage Your Taxes If Youre Suddenly Self-Employed. That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on net earnings. Self-employed individuals generally must pay self-employment SE tax as well as income tax.

Next multiply your self-employment. However you get to claim a deduction for a. For SE tax rates for a prior year refer to the Schedule SE for that year.

The standard rate is 153 which includes a 124 Social. You must pay self-employment tax if you had at least 400 of net income that didnt already have taxes withheld from it by an employer. You generally only pay self-employment tax on 9235 percent of your taxable profits.

100000 x 9235 92350. The self-employment tax rate is 153 of net income from self-employment but the Social Security portion of this tax is capped at the Social Security. Unfortunately when you are self-employed you pay both portions of these taxesfor a total of 153 percent.

Now for high income earners. The IRS lets you deduct 765 percent because thats what you would get to deduct if. The self-employment tax is 153 which is 124 for Social Security and 29 for Medicare.

SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. Ad Find Advice On Navigating Deductions and Paying Self-Employment Taxes. The self-employment tax rate is 153 of net earnings.

The amount increased to 147000 for 2022. For example 2000 in self-employment tax reduces your taxable income by 1000. Self-employment tax is 153 of.

All your combined wages tips and net earnings in the current year. Figure out your net earnings subject to self-employment tax. Develop A Tracking System.

Generally it applies to self-employment earnings of 400 or more. That rate is the sum of a. Pays for itself TurboTax Self-Employed.

A self-employed taxpayer must pay both halves. In the 22 tax bracket that would mean an income tax savings of 220. Employed workers pay half of their Social Security and Medicare taxes and their employers pay the other half.

Learn More At AARP. Self-employment income is earned from carrying on a trade or business as a sole proprietor an independent contractor or some. Generally speaking 9235 of your net.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Schedule Se And 1040 Year End Self Employment Tax Stripe Help Support

Your Easy Guide To Self Employment Taxes Tax Queen In 2022 Small Business Tax Self Employment Business Tax

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How To Know When You Don T Owe Self Employment Taxes Small Business Tax Tax Deductions List Self Employment

Self Employed Federal Income Taxes Turbotax Tax Tips Videos

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Canadian Tax Return Deadlines Stern Cohen

10 Of The Most Common Self Employment Tax Deductions For 2021

Tax Tips For Self Employed Plus Self Employment Taxes Reminder Small Business Tax Tax Services Business Tax

How To File Self Employed Taxes In Canada

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Guidelines For Reporting Self Employment Income 2022 Turbotax Canada Tips

Organize Small Business Taxes Plus Free Printables Small Business Tax Tax Organization Business Tax

Personal Income Tax Brackets Ontario 2021 Md Tax

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

![]()

How To Save Taxes For The Self Employed In Canada Filing Taxes

How To Pay Less Tax On Self Employment Income Millennial Money With Katie